- The Product Prism

- Posts

- 💰💰 The Money Mindset

💰💰 The Money Mindset

Intro to Product Finance for Product Managers

Before we dive in, the Product Prism now has a referral system! 🎉

Dear Product Prism family, if you’ve enjoyed this newsletter and found value in it, could you help me grow our community by sharing it with just one person? Your support means the world to me, and together, we can reach even more PMs striving for greatness. Thank you so much 😊 ✨

Refer one (1) friend, and get a PM Interview Case Study Example to help you prepare for your next case study interview.

Refer ten (10) friends, and you'll receive a one-off 30-minute session with me to discuss anything related to product management or your growth.

With that out of the way, Let’s dive in! 🚀

In this issue

Product managers aren’t just building features—we’re managing investments. Every decision impacts the product’s financial viability, from prioritizing features to launching new initiatives. But how do you balance innovation with sustainable business goals?

Product finance for startups is about surviving early-stage challenges like the Valley of Death. For established products, it’s about optimizing revenue and scaling effectively.

In this issue, discover:

Why product finance is critical for PMs.

How startups can navigate early financial hurdles.

Revenue models and market types.

Collaborating with Finance teams: Speaking the language.

How to align features with ROI and strategic goals.

Introduction: Why Product Finance Matters

Product management is about more than creating features users love. It’s also about ensuring those features drive long-term value for the business. Without financial literacy, product managers risk making decisions that delight users but fail the bottom line.

The Role of Product Managers in Financial Decisions:

PMs are stewards of investment. Every decision— whether it’s adding a feature or targeting a new user segment—is an investment of time, resources, and money. Understanding product finance allows PMs to:

Evaluate the ROI of roadmap decisions.

Partner effectively with finance teams to forecast and measure impact.

Ensure their product aligns with the company’s financial goals.

Bridging the Gap Between Vision and Profitability:

Finance and product often seem like separate worlds. However, by working together, they can balance creativity with financial discipline. For example:

Finance teams help validate assumptions about user willingness to pay.

Product teams provide insights into user behaviour that inform financial forecasts.

Surviving the Valley of Death ☠️

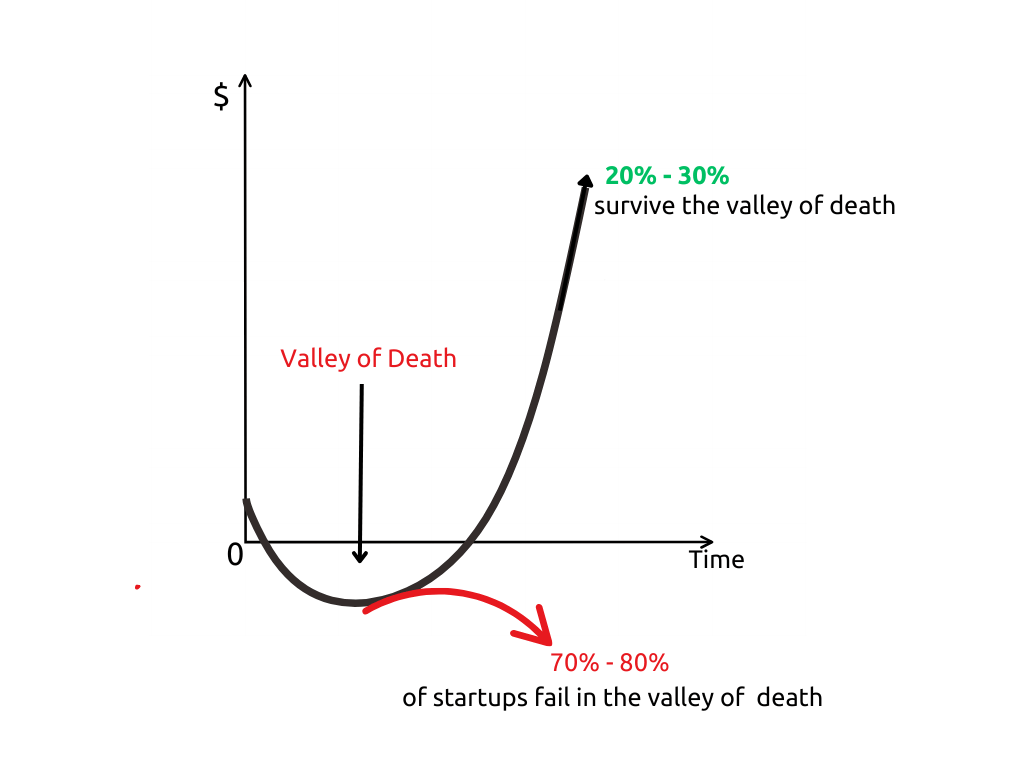

The Valley of Death refers to the precarious early phase of a product’s life when costs (development, marketing) outweigh revenue. Many products fail here due to a lack of financial planning.

70-80% of startups are estimated to fail during this phase, particularly due to:

Running out of funding or cash flow.

Unproven revenue models: No clear path to profitability.

High upfront costs: Development, testing, marketing.

Inability to validate a product-market fit.

Premature scaling: Overinvestment without market validation.

These figures highlight the critical need for financial planning, lean operations, and rapid validation during early product development.

How to Survive It:

Focus on MVPs (Minimum Viable Products): Launch lean to validate ideas before scaling.

Identify your revenue model early: Know how the product will generate income.

Monitor burn rate: Keep expenses in check to extend your runway.

Startups: Valley of Death

Revenue Models: How Products Make Money💰💰

What is a Revenue Model?

A revenue model defines the strategy your product uses to generate income. It’s not just about how much money you make but also about the flow of value between your product, its users, and other stakeholders. The choice of a revenue model directly impacts your product’s scalability, profitability, and long-term sustainability.

Types of Revenue Models in Tech

Subscription Model

How It Works: Users pay a recurring fee (monthly or annually) for access to your product or service. E.g. Netflix and Spotify.

When to Use:

Your product provides ongoing value (e.g., streaming content or SaaS tools).

Predictable revenue streams are critical to your business model.

Freemium Model

How It Works: The base product is free, but premium features are available at a cost. E.g. Canva, Slack.

When to Use:

You aim to acquire a large user base quickly.

Upselling premium features can drive revenue.

Pay-Per-Use Model

How It Works: Users are charged based on usage levels. E.g. Amazon Web Services (AWS), ride-sharing apps.

When to Use:

Variable usage creates value (e.g., cloud computing or utilities).

You want to appeal to cost-sensitive users.

Ad-Based Model

How It Works: Revenue is generated by displaying ads to users. E.g. Google Search, Facebook.

When to Use:

You have a large user base and want to keep the product free for them.

Your product can provide valuable data or targeting opportunities to advertisers.

Commission Model

How It Works: Revenue comes from taking a percentage of transactions between two parties. E.g. Airbnb, Uber.

When to Use:

Your product facilitates transactions between buyers and sellers.

Both parties derive significant value from the platform.

Licensing Model

How It Works: Charge other businesses to use or distribute your product. E.g. Microsoft Office, Game console manufacturers.

When to Use:

You target businesses that rely on your technology for their operations.

Combining Revenue Models: A Hybrid Approach

Many successful products and companies don't rely on a single revenue model. Instead, they combine multiple streams to maximize profitability, reduce risk, and stay competitive. This approach allows businesses to cater to different customer segments, monetize distinct aspects of their product or service, and adapt to changing market conditions. For example,

Spotify's freemium model (free version with limitations) + subscription model (premium features for paying users).

Microsoft's diverse revenue models across different business segments:

Azure (cloud computing): Multi-faceted revenue model: Pay-as-you-go, subscription-based model, partner ecosystem, license-based, marketplace revenue etc.

Microsoft Office: Uses a subscription-based model (Office 365), a traditional licensing model, freemium for web

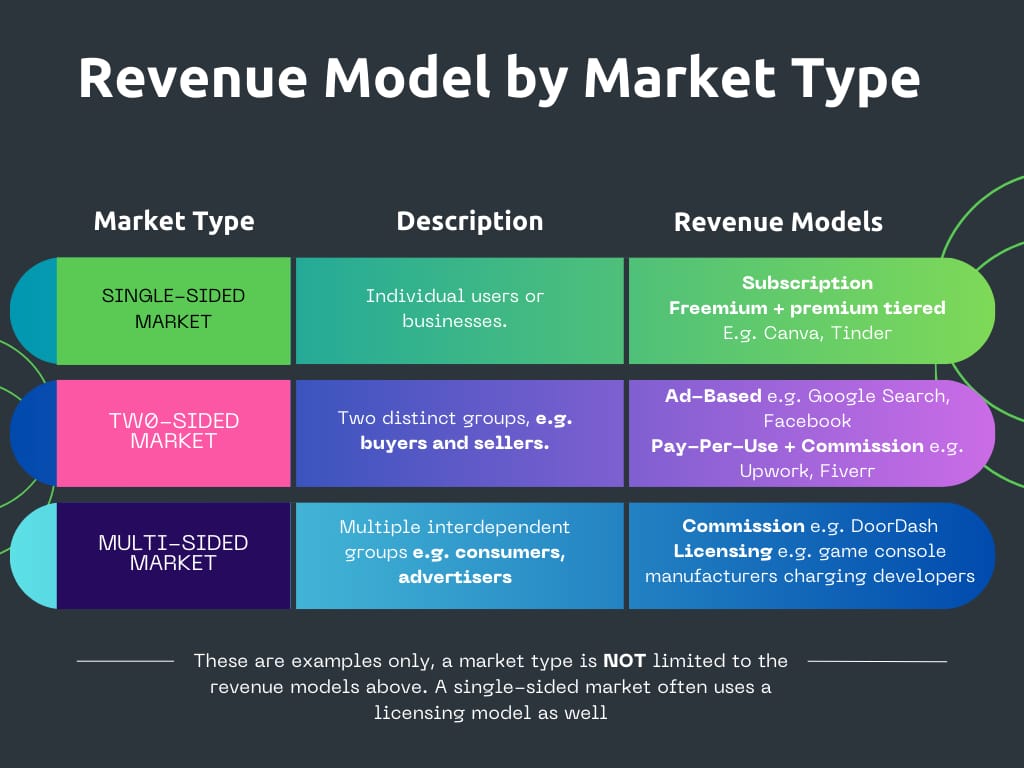

Key Considerations When Choosing a Revenue Model

Target Audience Preferences:

Do your users prefer to pay upfront, over time, or not at all? For example, younger users may lean toward freemium models, while businesses favor subscriptions.

Market Type:

One-sided markets often fit subscription or pay-per-use models.

Two-sided or multi-sided markets may monetize one group (e.g., advertisers) while offering free access to another.

Scalability:

Can the model grow profitably as your user base expands? For instance, freemium models often struggle with free-tier costs during rapid growth.

Cost Structure:

Ensure the revenue generated offsets operational and customer acquisition costs.

Flexibility for Pivoting:

Startups often evolve revenue models as they gain market insights. For example, YouTube pivoted from a pay-per-view to an ad-based model.

Pro Tip:

As your product matures, your revenue model may evolve. Startups often pivot models based on market feedback, while mature products optimize for retention and scalability.

Collaboration with Finance Teams 🤝

To drive sustainable growth, product managers must work closely with finance teams. Building this partnership requires speaking the same language, aligning goals, and leveraging financial tools effectively.

Unit Economics: Speaking the Same Language

Understanding basic financial concepts ensures smooth communication and alignment with finance teams. Here are key terms every product manager should know:

Revenue and Gross Margin: The income generated and the percentage remaining after subtracting direct costs.

CAC (Customer Acquisition Cost): The cost of acquiring a single customer. High CAC can erode profits, especially for early-stage products.

LTV (Lifetime Value): The total revenue a customer brings over their relationship with your product. LTV should always exceed CAC for profitability.

Payback Period: How long it takes to recoup the CAC. Shorter payback periods improve cash flow.

Burn Rate: The rate at which you’re spending cash. Monitoring burn rate helps you plan your runway effectively.

ARR (Annual Recurring Revenue): The total recurring revenue a product generates annually from subscriptions.

ARPU (Average Revenue Per User): The revenue generated per user or account, usually calculated monthly or annually. It shows how effectively a product monetizes its users and is useful for comparing user segments or tracking the impact of pricing changes.

Pro Tip: Ask your teams, such as account management, sales, and product marketing, to explain these metrics in the context of your product. For example, how does your product’s CAC compare to other company offerings?

Balancing Innovation with Financial Goals ⚖️

It’s easy to prioritize exciting features or bold ideas, but how do you balance that with financial sustainability?

Tips for Balancing Innovation and Finance:

Align features with revenue goals: Focus on features that improve retention, drive upsells, or lower costs.

Collaborate with Finance: Partner with your finance team to forecast revenue and costs for roadmap decisions.

Test, Learn, Scale: Validate features before committing to expensive development.

Example: Imagine you’re adding a premium feature to a freemium product. Work with finance to model how many users need to convert for the feature to be profitable.

Question & Answer 🙋♀️

Q: I don’t have a finance background. How can I contribute to financial discussions as a PM?

A: Start small. Learn basic metrics like CAC and LTV. Ask questions during discussions with finance colleagues—they’ll appreciate your interest and help you bridge gaps in knowledge.

Q: How do I justify financially risky features to stakeholders?

A: Build a business case that highlights:

The potential ROI of the feature.

The opportunity cost of not building it.

How it aligns with strategic goals (e.g., customer retention or acquisition).

Q: How can a startup manage burn rate effectively?

A: Prioritize lean operations, launch an MVP, and secure funding to sustain iterations.

Q: What’s the best way to choose a revenue model for a 0 to 1 product?

A: Focus on simplicity and scalability. Start with freemium or subscription to validate demand and pivot if needed.

Take Action ✅

This week, take one step toward mastering product finance:

Identify your product’s market type and revenue model and assess if your current revenue model aligns.

Calculate key metrics like CAC and LTV for your product.

Schedule a conversation with your account or finance team to explore how profitability is evaluated.

If you liked this newsletter, please share it with your friends and colleagues. 👯♀️

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.